Life Insurance in and around Lawton

Protection for those you care about

What are you waiting for?

Would you like to create a personalized life quote?

Protect Those You Love Most

It may make you weary to focus on when you pass away, but preparing for that day with life insurance is one of the most significant ways you can express love to your partner.

Protection for those you care about

What are you waiting for?

Life Insurance You Can Trust

Having the right life insurance coverage can help loss be a bit less overwhelming for those closest to you and provide space to grieve. It can also help cover important living expenses like phone bills, retirement contributions and college tuition.

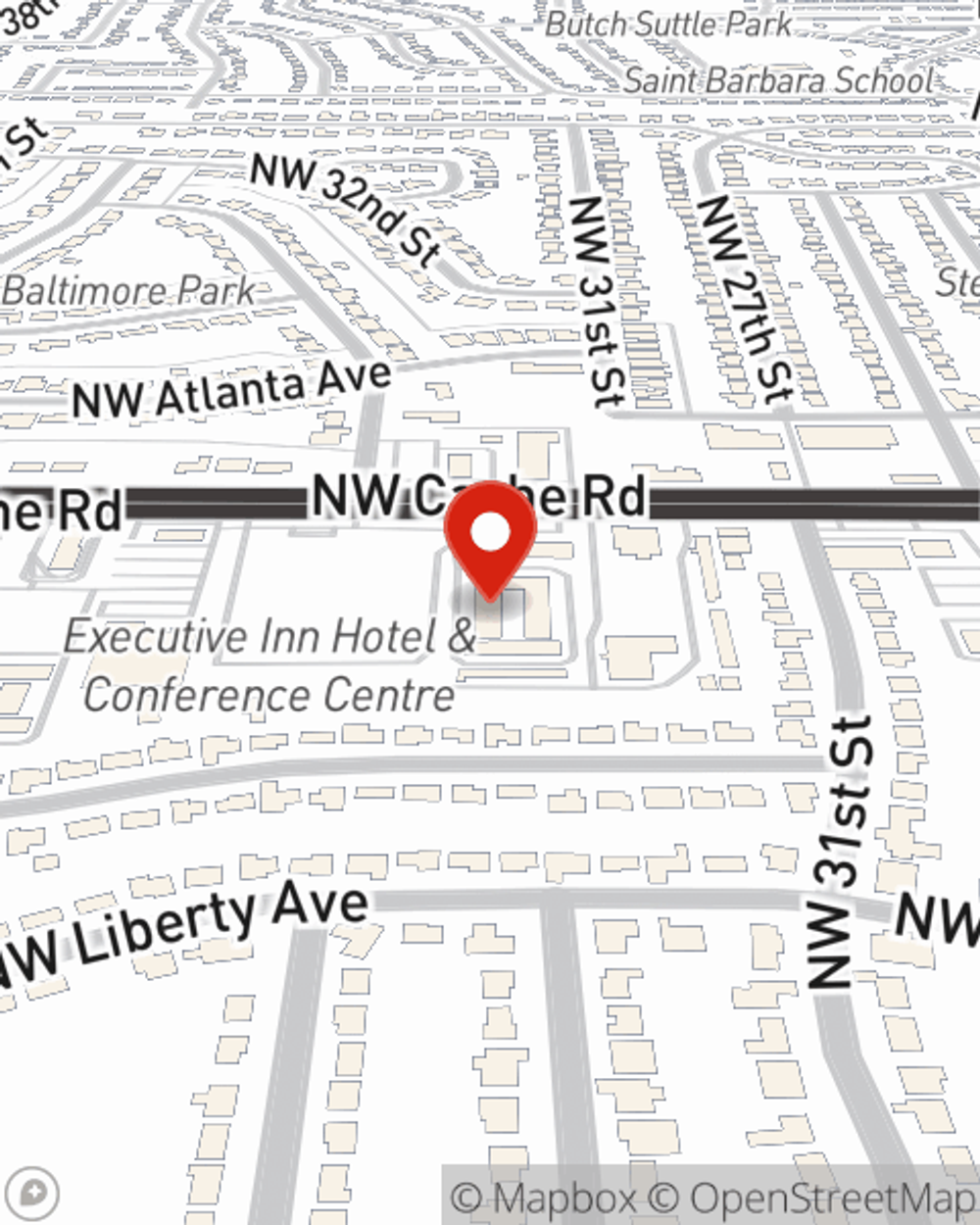

When you and your family are insured by State Farm, you might not have to worry because even if something bad does happen, your loved ones may be protected. Call or go online today and see how State Farm agent Robert Hughes can help you protect your future.

Have More Questions About Life Insurance?

Call Robert at (580) 357-6230 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Robert Hughes

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.